REBUILDING A BROKEN MARKET: RARE EARTHS AND A NEW MARKET INFRASTRUCTURE

For years, rare-earth markets appeared to function around Chinese benchmark prices. Production concentration inside China, declining liquidity elsewhere, and the migration of transactions into opaque contract channels had steadily eroded external price discovery. When structured pricing arrangements emerged in mid-2025 — most visibly through MP Materials and the United States Department of Defence — they did not cause the breakdown; they revealed it. Capital markets were left without credible benchmarks on which to finance new non-Chinese supply. A paper circulated in July 2025 reframed the problem as one of market structure rather than price levels, arguing that restoring liquidity, demand anchoring, and continuous transaction flow was essential to rebuilding price formation outside China. This paper traces how that market-reconstruction logic has since moved from analysis to policy, culminating in Project Vault — structured through the Export-Import Bank of the United States — which targets market infrastructure rather than price support. Rather than raising prices, the new framework rebuilds the market itself

WHEN THE FRACTURE BECAME VISIBLE

When MP Materials announced its structured pricing arrangement with the United States Department of Defence last July, it was not the moment the rare-earth pricing system broke — it was the moment the break was publicly acknowledged. For years, Chinese domestic benchmarks had been treated as global reference points even as real transactions quietly drifted away from them. July simply forced the industry to recognise what had already happened: published prices no longer reflected real clearing prices outside China.

Behind those benchmarks, the market itself had changed. Rare-earth production progressively concentrated almost entirely inside China. Non-Chinese mines closed or stalled under sustained low prices. Processing capacity outside China disappeared. Export volumes became residual rather than central to the industry. As supply moved inward, liquidity followed, and price formation followed with it. At the same time, transactions migrated into confidential long-term contracts with major Chinese buyers, export controls added friction, and spot liquidity thinned to marginal activity. What remained offshore were fragmented, opaque trades that could not support genuine price discovery.

The result was structural. There was no longer a credible external clearing market at all. Published prices reflected internal Chinese dynamics rather than global reality. For capital markets assessing new supply projects outside China, there was no transparent benchmark on which to rely. Investment stalled even as physical conditions tightened. Over subsequent months, availability thinned further, Chinese domestic prices firmed, and export liquidity deteriorated. The market was under supply pressure, yet capital remained constrained because price discovery outside China no longer existed

REFRAMING THE PROBLEM: FROM PRICE LEVELS TO MARKET STRUCTURE

Shortly after this became evident, a paper circulated within a small Telegram group reframed the issue away from price levels and toward the market mechanism itself. It argued that the rare-earth challenge was no longer primarily about scarcity or Chinese dominance, but about the collapse of price formation outside China.

With production overwhelmingly Chinese, most volume tied up in opaque contracts, and spot liquidity effectively gone, there was no longer any process through which transparent prices could form for the rest of the world. Capital markets were being asked to finance projects against reference prices that no longer represented real transactions

THE JULY FRAMEWORK: REBUILDING THE MARKET

The paper suggested that without reconstructing market structure, neither optimism nor subsidies would unlock meaningful non-Chinese supply. The solution was not price intervention but market formation.

Large-scale non-Chinese demand needed to be deliberately anchored to restore liquidity. Repeatable transaction flows would generate a genuine external benchmark grounded in real clearing prices. A dynamic stockpile would continuously rotate material through the market, preventing the stop-start trading that had destroyed liquidity. Once continuous price formation existed, banks and investors would finally have something real to underwrite.

The logic was straightforward: without sustained demand there is no market; without a market there is no price discovery; without price discovery capital will not fund production. Volumes around 10,000 tonnes of NdPr oxide were identified as the minimum scale required to move from symbolic trades to true market-making liquidity.

The objective was not to support prices, but to recreate a functioning market outside China.

FROM THEORY TO POLICY: PROJECT VAULT

Seven months later, policymakers arrived at a similar structural conclusion.

In February 2026, Project Vault — structured through the Export-Import Bank of the United States — was announced as a national framework to stabilise critical mineral supply chains. It was not designed as a price floor or a subsidy programme. It directly addresses the market failure that had constrained investment.

Project Vault anchors large, guaranteed demand from strategic buyers and channels it through structured, repeatable transactions rather than one-off offtake agreements. By standing behind those flows with credit support and risk compression, it restores continuous liquidity and enables transparent transaction pricing at scale. Rather than manipulating price, it restores the mechanism that produces price.

It is market-infrastructure policy rather than supply subsidy.

THE CONVERGENCE

Placed alongside each other, the July framework and Project Vault follow the same structural logic. The paper argued that functioning markets had to be rebuilt through anchored demand, continuous liquidity, dynamic stock rotation, and transaction-driven price discovery before capital would return. Project Vault now applies those same principles at institutional scale.

The form differs. The underlying mechanics do not.

What unfolded between July and February reflects a shared diagnosis of the same market failure. Both independent analysis and policy design reached the conclusion that resilient supply chains require functioning markets rather than price intervention, that price discovery must be rebuilt through real transactions and liquidity, and that capital responds to transparent, credible benchmarks.

Project Vault is not about supporting prices.

It is about restoring market structure.

And in doing so, it mirrors the framework that emerged when the rare-earth pricing system’s structural breakdown became visible.

ADDENDUM:

From Analysis to Action — The July 2025 Framework

The following paper was circulated privately on 7 July 2025 — three days before the public announcement of structured pricing arrangements between MP Materials and the U.S. Department of Defence — and reframed the rare-earth crisis as a failure of market structure rather than price levels

At the time, the dominant policy debate remained centred on subsidies, price support, and isolated offtake agreements. The July framework instead argued that the core failure was structural: without functioning markets, transparent price formation could not exist — and without price discovery, capital would not fund new non-Chinese supply.

Seven months later, Project Vault institutionalised many of these same principles at national scale.

This addendum is included not as commentary, but as contemporaneous evidence of the analytical foundation that anticipated today’s market-infrastructure approach.

View July paper here :https://www.thebrownpaper.net/s/July-Concept-summary-madh.pdf

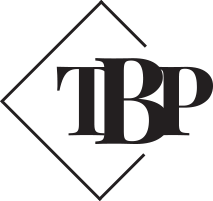

PRICE FLOORS, MARKET SIGNALS AND THE RACE TO COMPETE WITH CHINA

Why stabilisation emerged, why it is evolving, and what true supply-chain competitiveness requires

The debate around rare earth price floors is often framed as a choice between market forces and intervention. Price stabilisation emerged after a period of severe market dysfunction, when pricing collapsed below production costs across the industry and threatened the survival of non-Chinese supply chains altogether. Since then, prices have rebounded sharply, but the legacy of that collapse continues to shape capital behaviour and policy thinking. Support mechanisms that once served to stabilise a broken market are now increasingly being reassessed as attention shifts toward building supply chains capable of competing directly with China on cost, scale and reliability. This paper examines why price floors are justified when markets are distorted, why their role is evolving as economics and geopolitics change, and why long-term supply-chain independence will ultimately depend on competitiveness and volume adoption rather than permanent pricing protection.

A DEBATE BORN OF A BROKEN MARKET

For much of the past two years the debate around rare earth price floors has been framed as a binary choice between free markets and intervention. In practice it has been shaped far more by broken market conditions, national security concerns and the behaviour of capital itself. That tension resurfaced in late January when a report by Reuters suggested that U.S. policymakers were stepping back from the idea of guaranteeing minimum prices for critical minerals projects, instead emphasising the need for projects to demonstrate commercial viability without pricing support. Based on unnamed sources, the article was interpreted by markets as a potential retreat from one of the stabilisation tools that had emerged during the sector’s recent downturn.

The market reaction was immediate, with rare earth and critical-minerals equities falling sharply as investors once again repriced policy risk into project economics. Commentary that followed, including analysis carried by Yahoo Finance, made clear that price floors had not generally been viewed as permanent protection but rather as transitional mechanisms designed to reduce early cash-flow risk in a market that had ceased to function normally. When MP Materials subsequently clarified that its existing arrangements remained unchanged, and Reuters softened elements of its original framing, it became evident that the repricing had not been about operational fundamentals. It had been about confidence in how Western supply chains would ultimately be built.

That same question soon surfaced publicly in a LinkedIn exchange involving Mark Jensen of ReElement Technologies Corporation and policy-finance voices associated with the Export-Import Bank of the United States. What emerged was not a clash of ideology but two phases of the same industrial transition: the need to unlock capacity in a damaged market, and the necessity of ultimately building supply chains capable of competing without permanent protection

WHEN PRICING STOPPED MAKING ECONOMIC SENSE

To understand why price floors entered the discussion at all, it is only necessary to look back a short distance. The lowest NdPr pricing point was not years ago but barely eighteen months ago, when prices collapsed to around forty-five dollars per kilogram. These levels did not merely compress margins; they failed to cover production costs across the industry, including for many Chinese producers themselves. This was not a normal commodity downturn but evidence that pricing could be driven below sustainable economics for extended periods, even at the cost of losses within China.

For capital markets, that moment reshaped risk perception. What had once been treated as cyclical volatility began to look like structural price warfare. Financing retreated, equity risk premiums rose sharply, and new project development slowed dramatically. It was in this environment of systemic market failure, rather than ordinary cyclical weakness, that stabilisation tools emerged. They provided a bridge when the market offered no natural support mechanism, but they also carried a strategic message. China’s dominance had long relied on a familiar cycle of aggressive capacity expansion, deliberate price suppression to eliminate competitors, and subsequent tightening once alternatives disappeared. Price floors represented the West’s first serious attempt to neutralise that mechanism, functioning as deterrence as much as financial stabilisation

RECOVERY, BUT WITH DISCIPLINE RATHER THAN OPTIMISM

Since that collapse pricing has rebounded sharply. Chinese domestic spot prices have roughly doubled, while FOB China prices paid by the rest of the world before tariffs have almost tripled. Yet the recovery has not restored an easy environment for the sector. Instead it has introduced selectivity. For the most competitive projects, those with disciplined capital structures, integrated processing and resilient cost curves, today’s pricing is clearly economic and, in some cases, highly attractive. For many higher-cost developments, however, it remains marginal. The market has not returned to broad optimism; it has imposed discipline. Capital is now filtering aggressively toward projects capable of surviving another downturn rather than those dependent on favourable pricing alone

THE SHADOW OF THE COLLAPSE STILL SHAPES CAPITAL

Despite the rebound, financing behaviour has not reset. The forty-five-dollar trough remains the dominant reference point in risk models, investment committees and lender stress tests. Projects are assessed less on whether they work at today’s prices than on whether pricing can again be forced below sustainable levels and for how long. This lingering memory explains both why stabilisation tools emerged and why markets remain extraordinarily sensitive to policy signalling around them. Investors are not reacting to current revenue strength; they are reacting to perceived downside protection.

FROM STABILISATION TOWARD COMPETITIVE STRUCTURE

As geopolitics and economics continue to evolve, policy tools are evolving with them. With prices now economic for the strongest projects and capital increasingly able to distinguish resilience from fragility, broad price intervention is becoming less necessary and potentially counterproductive. What is emerging instead is conditional support tied to competitiveness, backing supply chains expected to scale precisely because they are capable of standing on their own. Support is increasingly being provided where it is unlikely to be needed indefinitely. The objective is no longer simply to ensure supply exists but to build supply chains capable of surviving and winning in open markets.

This is where the long-term logic articulated by Jensen aligns with the direction of travel. Competitiveness, not permanent protection, is the only sustainable endgame. At the same time, intervention remains justified when markets are distorted or temporarily broken. When pricing ceases to reflect economic reality and instead functions as a strategic weapon, stabilisation preserves future competition rather than replacing it. In that sense, intervention operates as a bridge — necessary when markets fail, but designed to become irrelevant as competitive structures emerge

WHY PRICE WITHOUT VOLUME IS NOT A STRATEGY

What is often lost in upstream debate is that mining economics depend on volume as much as price. High pricing alone does not create a viable industry if it undermines downstream adoption. Rare earth producers ultimately require sustained throughput into magnets, motors and manufacturing supply chains. In practical terms, zero volume multiplied by a high price still equals zero. If artificial pricing mechanisms push feedstock costs above globally competitive levels, downstream manufacturers do not absorb those increases out of strategic loyalty; they source elsewhere, and in today’s market that almost always means China.

China’s dominance was never built on maximising price per tonne but on maximising throughput across the entire value chain. Lower margins, massive volume and industrial scale created resilience that no high-price, low-volume model can replicate. Permanent or elevated price intervention risks supporting upstream optics while quietly destroying the volume base that makes long-term mining economics viable. Mines may be built while markets are still lost.

Recent pricing dynamics may even suggest a shift in strategy. Where oversupply once crushed non-Chinese miners directly, tighter feedstock control now appears to raise costs downstream outside China, making rest-of-world magnets and finished products less competitive while preserving domestic advantage. Whether driven by policy intent or supply-demand mechanics, the effect aligns perfectly with Chinese economic objectives: dominance maintained not by eliminating mines, but by controlling manufacturing competitiveness.

A LIGHT AT THE END OF THE TUNNEL

What is encouraging is that early signs are beginning to emerge of a shift in thinking, from a framework driven almost entirely by national security supply concerns toward one increasingly informed by competitiveness. In the immediate aftermath of the price collapse, the overriding objective was simply to ensure that non-Chinese supply chains survived at all. Stabilisation tools emerged because the market had ceased to provide that security. As prices recover and capital discipline slowly returns, a longer-term perspective is starting to take hold among parts of the market. The conversation is no longer exclusively about guaranteeing supply at any cost but increasingly about how to build supply chains capable of competing on price, reliability, scale and integration.

This shift is far from complete. Many projects remain in a phase where survival and early support still dominate decision-making, but alongside this a growing cohort of investors, policymakers and industrial players are beginning to focus on structural competitiveness as the true endgame. What is emerging is not yet a transformation but a direction of travel — a light at the end of the tunnel rather than the destination itself.

Supply that exists only because it is protected remains strategically fragile, while supply that wins volume in open markets becomes durable. Price floors help repair broken markets. The future will be built by competitive supply chains. Independence will not be secured by protected prices, but by the ability to compete — and to sell at scale.

WHEN THE INPUTS CHANGE

This paper offers an interpretation of Mark Carney’s Davos 2026 speech, which framed the current moment as a rupture rather than a transition in the global economic and geopolitical landscape.

Using the speech as a point of reference, it examines how changes in incentives, constraints, and risk have altered the behaviour of states and markets — particularly as tools once associated with efficiency, such as tariffs, supply chains, and trade access, are increasingly used as instruments of leverage.

The focus is analytical rather than prescriptive, exploring why language rooted in an earlier phase of global integration now struggles to describe how the system is experienced in practice, and why recognising that gap matters for credibility, resilience, and cooperation.

MARKETS, POWER, AND THE END OF COMFORTABLE FICTIONS

At the World Economic Forum in Davos in early 2026, Mark Carney’s address stood out not for its rhetoric, but for its clarity. Framed around the idea that the global system is experiencing a RUPTURE RATHER THAN A TRANSITION, the speech applied economic reasoning to geopolitical reality in a way that visibly resonated with the audience, culminating in a rare standing ovation.

Carney spoke from Canada’s experience as a middle power deeply integrated into global trade, finance, and supply chains, and therefore among the first to feel the consequences when long-standing assumptions no longer hold. His argument was grounded not in ideology, but in economics: systems behave according to incentives and constraints, and when those inputs change, outcomes change with them.

This paper takes Carney’s speech as a point of reference, not as a response or critique. Its purpose is to explore the economic logic behind the moment that caught the imagination at Davos, and to examine why language rooted in an earlier phase of global integration now struggles to describe how the system is being experienced in practice.

HOW SYSTEMS ACTUALLY BEHAVE

Economic systems are often described in moral or institutional terms, but they are ultimately governed by incentives. Cooperation persists when it is cheaper than coercion. Integration deepens when it reduces risk. Stability endures when predictability outweighs asymmetry.

For several decades, the prevailing global framework broadly met those conditions. Efficiency was rewarded, concentration was tolerated, and enforcement gaps were accepted because outcomes were largely positive. Even where the system was imperfect, the benefits of participation outweighed the costs.

That equilibrium has changed.

When the cost of coercion falls relative to the cost of cooperation, rational actors adapt. This is not a question of values eroding or intentions hardening; it is a matter of behaviour responding to altered constraints. Markets recognise this instinctively. Political systems often lag.

TARIFFS, LEVERAGE, AND THE REPRICING OF RISK

One of the clearest signals that inputs have changed is the evolving role of tariffs. Historically framed as economic tools to correct imbalances or protect domestic industries, tariffs are increasingly deployed to exert political leverage as well as economic pressure.

This shift matters not because tariffs are new, but because their function has changed. They now operate simultaneously as signalling devices, bargaining instruments, and mechanisms of constraint. Once this occurs, they cease to be neutral economic adjustments and become strategic tools.

The same logic applies more broadly. Trade access, regulatory approval, and participation in supply chains increasingly carry conditionality. What was once assumed to be governed by rules and norms is now more explicitly transactional.

For middle powers such as Canada, this is experienced not as theory but as exposure. Since the beginning of last year in particular, the pace and visibility with which economic instruments have been deployed has made previously abstract risks immediate and tangible. What could once be absorbed quietly within existing frameworks now demands structural response.

RARE EARTHS: DOMINANCE BUILT WITHIN THE SYSTEM

The rare earths market provides a clear empirical example of how leverage emerges INSIDE a rules-based framework rather than outside it.

China’s dominance in rare earth production and processing was not established through overt rule breaking. It was built by operating within the system’s tolerated asymmetries: accepting lower margins, internalising environmental and capital costs others externalised, and benefiting from a global preference for efficiency over resilience.

For years, this concentration was viewed as an economic outcome rather than a strategic risk. The system rewarded lower costs and reliable supply, even as dependency deepened. Only once dominance was established did integration itself become leverage.

This is a critical distinction. The system did not fail to prevent dominance; it enabled it. The resulting vulnerability was not imposed externally but accumulated internally over time.

WHEN EFFICIENCY BECOMES EXPOSURE

The same economic logic has since appeared across other strategic domains. Supply chains optimised for scale, cost, and reliability have increasingly been reinterpreted through a lens of dependency and exposure once concentration became visible.

In such cases, market mechanisms alone proved insufficient. Export controls, licensing regimes, and regulatory constraints followed — not as ideological choices, but as economic responses to newly recognised leverage.

This dynamic is not confined to any one country or administration. Many of these mechanisms’ pre-date recent political cycles. What has changed is the explicitness with which they are now applied, and the speed with which they are felt by countries positioned between major powers.

The lesson is not that integration was a mistake, but that integration without regard to concentration creates latent risk. Once revealed, that risk is rarely resolved through markets alone.

WHEN LANGUAGE LAGS REALITY

One of Carney’s most pointed observations was that continued reliance on the language of a “rules-based international order” increasingly obscures more than it clarifies.

This is not an argument that rules no longer exist, nor that institutions have collapsed. It is an argument that the system no longer functions AS ADVERTISED. When description lags reality, risk is mispriced. When risk is mispriced, shocks become more likely and responses more abrupt.

Markets adjust quickly to new information. Political language often does not. The gap between the two is where fragility emerge

WHAT THIS IS — AND IS NOT

This paper does not suggest is decoupling, economic isolation, or bloc formation. Nor does it seek to assign motive or apportion blame. Its focus is narrower: to describe how incentives have shifted, how leverage has emerged, and why behaviour has changed as a result.

CONCLUSION

The standing ovation at Davos was not a response to nostalgia. It reflected a recognition that many in the room were already living with the consequences Mark Carney described.

When economic tools are repurposed as instruments of leverage, when efficiency gives way to exposure, and when language no longer matches experience, systems do not adjust gradually. They rupture.

For middle powers, the challenge is not whether to adapt — they must — but whether adaptation is driven by denial or by realism. Naming reality does not foreclose cooperation; it makes genuine cooperation possible.

Those able to recognise where change is occurring, and to adapt accordingly, will be best placed to navigate the world that is now forming, and the geopolitics within it.

Using Tools Doesn’t Remove Responsibility

Reflecting on the difference between using tools to explore ideas and presenting arguments as if they are settled. Tools can assist thinking and improve clarity, but responsibility for what is published — and its consequences — remains with the author.

I use tools to help shape ideas, and I often bounce arguments around before they’re finished — whether with peers, colleagues, or an AI agent.

But there’s a clear difference between exploring an idea and presenting an argument as if it’s settled.

We’re already seeing the risk of blurring that line with AI hallucinations: systems confidently filling gaps, inventing references, or replacing missing facts with something that sounds right. Not because it’s true, but because it’s plausible.

I use polish. I use tools. But I read what I write. I check the logic. I try to understand the implications of the argument before I put my name to it.

The problem starts when polish substitutes for understanding.

If users rely on systems that smooth language, infer intent, and quietly replace uncertainty with plausibility, responsibility gets diluted. The argument looks coherent, but it hasn’t been properly stress-tested.

History suggests that serious mistakes rarely begin with obviously bad ideas. They begin with arguments that sounded reasonable enough not to be questioned.

At the end of the day, the person claiming authorship is responsible — for the content, and for the consequences. Tools don’t change that. Presentation doesn’t dilute it. Plausibility doesn’t excuse it

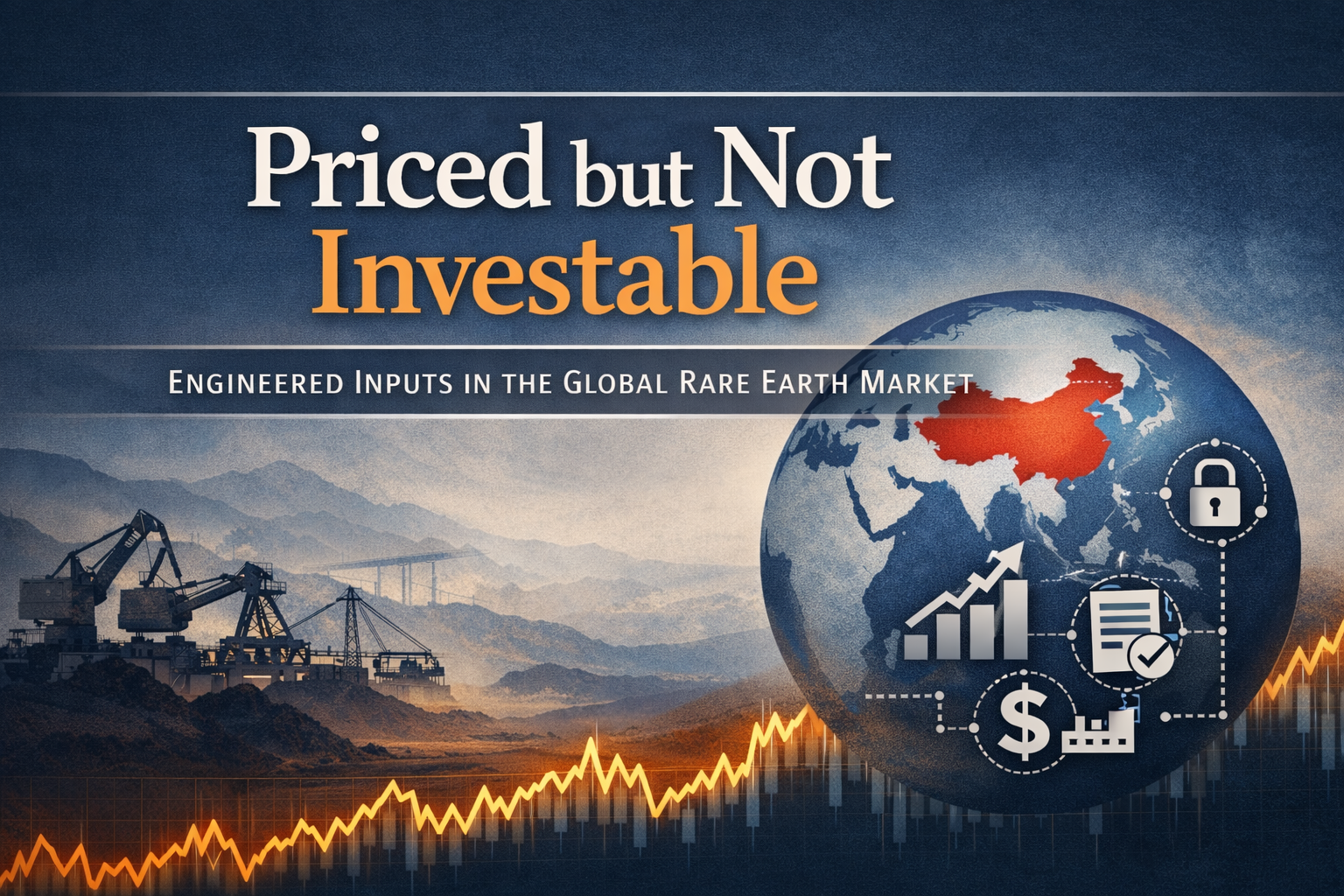

PRICED BUT NOT INVESTABLE: WHY RARE EARTH MARKETS FAILED — AND WHY THE SOLUTION IS BEING ENGINEERED

The global rare earth market has already failed in its most basic economic function: it no longer converts scarcity into investable supply. Prices exist; demand exists yet supply outside China has not responded. The market has delivered exactly the outcome implied by its inputs.

This is why rare earths can be priced but not investable.

This failure is not new. What is new is that both sides of the market have now accepted it.

China has concluded that the pricing and export model that once supported both global supply and domestic industrial expansion no longer serves its strategic objectives. Export availability is now conditional, domestic value capture is prioritised, and Chinese prices no longer clear a global market.

At the same time, the rest of the world has recognised that rhetoric, strategy papers, and price observation do not create supply. Markets are outcomes, not instruments. When outcomes fail, the inputs must change. Duration, risk allocation, access certainty, and contract-backed pricing are now being deliberately engineered to produce a different outcome.

The market itself is unchanged. The conditions under which it operates are not.

1. WHEN THE CHINESE PRICE WAS THE MARKET PRICE

Markets are immutable in their function: they translate inputs into outcomes. When outcomes fail, it is the inputs—not the market—that must be examined.

In rare earths, prices and demand have been visible for more than a decade, yet investable supply outside China has not emerged. This paper argues that the market has behaved rationally, and that the current phase reflects a deliberate re-engineering of inputs to correct for a structurally failed outcome.

For much of the past two decades, global rare earth pricing operated as if there were a single market price. In practice, that price was set in China.

This outcome did not arise from explicit monopoly behaviour or formal coordination. It reflected China’s position at the centre of the rare earth value chain and, critically, its role as the source of marginal supply. If additional demand could be met by Chinese production and exports, Chinese prices functioned as the global clearing price for rare earth oxides, including neodymium–praseodymium (NdPr).

During this period, Chinese domestic prices were broadly usable as external references. Differences between domestic and export prices were largely mechanical, reflecting value-added tax, logistics, and timing rather than structural scarcity. Where differentials appeared, arbitrage ensured convergence. Buyers outside China could reasonably expect that material quoted at a Chinese price would be available, in volume and on predictable terms.

This pricing structure suited both sides of the market. Chinese producers benefited from scale and steady demand, while buyers elsewhere optimised procurement around availability and cost rather than redundancy. Rare earths were treated as industrial commodities with some political sensitivity, but not as materials requiring parallel supply chains.

Non-Chinese production did little to alter this dynamic. Alternative supply existed, but it lacked scale, continuity, and price-setting power. Pricing for these projects was anchored to Chinese references rather than formed independently. Without long-term offtake or underwriting, they could not establish an alternative clearing price.

Implicit in this system was an assumption that China would continue to supply incremental global demand. Successive increases in Chinese production quotas reinforced that belief. Quota growth was interpreted as export capacity, and export capacity was assumed to translate into market availability. The distinction between production growth and export elasticity was rarely interrogated.

That assumption sat alongside a long-standing and well-understood industrial logic. As Dudley Kingsnorth observed many years ago, the French would rather sell wine than grapes. From the outset, China’s rare earth strategy was not simply about supplying raw materials, but about using upstream control to develop an export-led industrial base. For many years, these objectives were compatible with continued exports of oxides and intermediates. China could move downstream while still supplying the rest of the world with materials.

Over time, however, the conditions that allowed this balance to persist began to change. Chinese domestic demand for rare earths grew steadily as magnets, motors, electronics, and other downstream industries expanded. At the same time, the capacity to supply both domestic demand and the rest of the world with upstream material began to narrow. That constraint is not yet absolute, but it is increasingly binding at the margin.

In this environment, China is no longer resolving the trade-off between domestic use and export supply through market forces alone. Instead, optionality has been embedded into policy and practice. Export availability has become conditional rather than elastic, influenced by licensing, end use, timing, and strategic priority. This preserves flexibility: upstream material can still be exported where it aligns with broader objectives, but domestic downstream industries are insulated from supply risk.

Whether this shift has been formally articulated or merely inferred through regulatory practice is ultimately secondary. What matters is the effect. Market participants now behave on the basis that export availability is discretionary and reversible, while domestic demand is structurally prioritised. That perception alone is sufficient to alter price formation.

In commodity markets, prices depend not only on cost and supply, but on confidence in continuity. Once continuity becomes uncertain, prices cease to clear purely on marginal economics. Risk premia emerge, contract tenors shorten, and procurement strategies adjust.

The practical consequence is that access to Chinese rare earth content is increasingly mediated through Chinese downstream industries. For many applications — particularly magnets — the most reliable, and in some cases the only, way to secure Chinese rare earth supply is to buy it already embodied in finished or semi-finished products.

The Kingsnorth logic has not changed. Value is still captured by selling wine rather than grapes. What has changed is that, as capacity tightens and optionality is preserved, China is no longer prepared to do both in parallel. At that point, the Chinese price ceases to function as a neutral global reference and becomes an internal price serving a domestic value chain.

2. CAPITAL SCARRING AND THE LOSS OF PRICE CREDIBILITY

The breakdown of confidence in rare earth price signals did not occur suddenly. It developed through two distinct episodes, separated by more than a decade, that together reshaped how Western capital evaluates risk in the sector.

The first occurred in 2010–11, when Chinese export quotas triggered a sharp rise in rare earth prices. At the time, the price response appeared to confirm long-standing concerns about supply concentration. Projects advanced rapidly on the assumption that higher prices reflected a durable tightening of supply rather than a temporary policy constraint.

That assumption proved misplaced. When export restrictions were subsequently relaxed following World Trade Organization rulings, prices fell as abruptly as they had risen. Projects that had relied on elevated prices to justify investment were left exposed. Mountain Pass failed; Lynas survived only because it was underwritten as a strategic asset rather than financed on commercial price assumptions.

The lesson absorbed by capital was not that rare earth prices were volatile, but that they were non-bankable. Prices driven by policy constraint could rise quickly, but they could also be reversed before capital could be deployed and recovered. Duration, not level, became the binding variable.

In the years that followed, awareness of rare earth supply risk did not diminish. On the contrary, it became increasingly explicit. Governments and agencies in the United States, Europe, Japan, and elsewhere produced a growing body of strategy papers, critical-minerals lists, and supply-chain assessments. These documents correctly identified concentration risk, downstream dependence, and the strategic importance of rare earths.

What they did not resolve was the central economic problem exposed by the first price rupture. Strategy papers acknowledged risk, but they did not change price formation. They did not address the conditions under which higher prices could be relied upon to persist, nor did they establish mechanisms for underwriting, offtake support, or price duration. Recognition increased, but investability did not.

This distinction became decisive during the post-COVID demand surge of 2022–23. Demand growth was real and broad-based, driven by electric vehicles, wind power, and industrial electrification. Prices rose in response, and for a brief period it appeared that demand-led pricing might finally support new supply outside China.

Once again, that expectation was disappointed. Chinese quota expansions outpaced realised demand, and multiple quotas releases compressed prices just as non-Chinese projects approached financing decisions. At the same time, policy frameworks multiplied, but they did not translate into binding commitments capable of stabilising prices over an investment horizon. No major rare earth project outside China secured or confirmed finance on the basis of higher prices alone.

By this point, the problem was no longer one of price level. It was one of price credibility. Rare earth prices no longer conveyed information that capital could rely on to assess risk, service debt, or recover investment. They reflected conditions shaped by policy discretion and internal demand priorities elsewhere, rather than an equilibrium accessible to new entrants.

The consequence has been a form of capital withdrawal that precedes supply response. Prices may rise in conditions of scarcity, but they do not attract investment. Without investment, supply cannot respond, and scarcity persists. The market enters a self-reinforcing cycle in which price signals exist but are no longer trusted.

This loss of trust is the central economic constraint facing the rare earth market today. It explains why repeated warnings about supply risk have not translated into new capacity, and why demand growth alone has proven insufficient to rebalance the system.

3. PRICE BIFURCATION AND THE RE-ANCHORING OF REFERENCE PRICES

3.1 FROM A SINGLE CHINESE REFERENCE PRICE TO SEGMENTED ACCESS

For most of the period in which Chinese prices functioned as the global reference, Chinese supply served domestic users and export markets simultaneously. Differences between domestic and export pricing were largely administrative, reflecting tax treatment, logistics, and timing rather than scarcity or prioritisation. Export availability was sufficiently elastic that price differentials were arbitraged away.

That condition has changed.

As Chinese domestic demand for rare earths expanded and downstream capacity deepened, Chinese supply became progressively segmented between domestic use and export. Material could still be exported, but access was no longer assured across volume, timing, or end use. Chinese supply shifted from clearing a single, integrated market to serving two distinct demand pools under different constraints.

This transition did not require a single formal policy announcement. It emerged incrementally through quota management, licensing discretion, and regulatory emphasis on downstream value creation. The effect was a change in how Chinese supply was accessed rather than how it was described.

From the perspective of buyers outside China, the critical shift was not price volatility but access uncertainty. Even where Chinese material remained nominally available, continuity could no longer be assumed. Contract tenors shortened, volumes became less predictable, and prioritisation mechanisms became more visible.

Once access becomes uncertain, a single Chinese reference price ceases to be meaningful. Chinese supply no longer clears a unified market; it clears segmented demand pools subject to different constraints. At that point, bifurcation becomes structural rather than episodic, while remaining specific to Chinese-origin material

3.2 DUAL PRICING IN CHINESE SUPPLY: SMM AND THE FORMALISATION OF BIFURCATION

For much of this transition, bifurcation in Chinese supply was inferred from behaviour rather than explicitly reflected in published prices. Market participants continued to reference a single Chinese price even as export conditions tightened and access became conditional.

That changed in December 2025.

At that point, Shanghai Metals Market (SMM), the most consistent and widely referenced source of rare earth pricing data, introduced a distinct FOB China price for NdPr oxide alongside its domestic Chinese delivery price. This marked a formal recognition that Chinese supply now clears two different markets.

The domestic delivery price published by SMM reflects transactions within China. It captures domestic availability, tax treatment, and demand from Chinese downstream industries. Increasingly, it reflects value capture rather than marginal production cost, indicating that pricing power within Chinese supply has shifted upstream in response to domestic demand.

The FOB China price applies only where Chinese export is licensed and permitted. It reflects not only production cost and logistics, but also the conditions attached to export access. Licensing risk, volume uncertainty, contract tenor, and end-use scrutiny are embedded in the price itself.

These two prices are not arbitrageable in practice. Even where nominal spreads appear modest, the constraints attached to export availability prevent convergence. Domestic buyers of Chinese material face continuity and scale; external buyers face discretion and uncertainty

Crucially, this bifurcation applies only to Chinese supply. Material produced outside China continues to clear a single market and does not face the same segmentation between domestic and export access. However, because Chinese supply has historically set the global reference price, bifurcation within Chinese supply has global consequences.

Once Chinese prices fracture in this way, they can no longer function as neutral global benchmarks. They transmit different information depending on whether the buyer is inside or outside China.

3.3 ROW Price Formation: Cost-Plus Anchoring and the Role of the China FOB Price

As Chinese pricing has become segmented, pricing for non-Chinese supply has begun to re-anchor around a different set of references.

For ROW producers, pricing is no longer meaningfully benchmarked against Chinese domestic delivery prices. Instead, it is increasingly triangulated between two constraints: the FOB China export price, where Chinese material remains available, and the cost of production plus an explicit return on capital required to make non-Chinese supply financeable.

This shift is most clearly illustrated by the United States Department of Defence agreement with MP Materials. At the time the agreement was announced, the implied NdPr price appeared elevated relative to prevailing Chinese benchmarks. Viewed against Chinese domestic prices, it was widely characterised as high.

That interpretation is no longer persuasive.

Once Chinese domestic prices are recognised as internal clearing prices, the appropriate Chinese comparator becomes the FOB China export price, which embeds export risk and conditional access. Against that reference, the MP Materials price no longer appears anomalous. Instead, it sits within a realistic range for supply that must be continuous, bankable, and independent of discretionary export policy.

More importantly, the MP Materials agreement makes explicit what the FOB China price only implies. It links price formation to production cost and capital recovery, rather than to short-term supply-demand dynamics that new entrants cannot rely upon. The price is designed to sustain operations across an investment cycle, not to clear a spot market.

Together, these two prices now define the effective bounds of ROW pricing. The FOB China price establishes the opportunity cost of relying on Chinese exports where they remain available. The cost-plus price defines the minimum level required to sustain non-Chinese production with acceptable risk-adjusted returns.

In this context, prices that once appeared artificially high now look increasingly realistic. They reflect not scarcity alone, but the full economic cost of supply continuity, including capital discipline and resilience.

This represents a fundamental shift in pricing logic. ROW supply is no longer waiting for prices to rise high enough, and long enough, to attract capital. Instead, prices are being specified to make supply viable in the first place, with demand risk managed contractually rather than left to volatile spot markets.

4. LANDED-COST MECHANICS AND THE BREAKDOWN OF PRICE COMPARABILITY

Once price formation fractures, comparison becomes non-trivial. The distinction between a quoted price and an economic price begins to matter, particularly for buyers outside China. This is most clearly seen in the mechanics of landed cost.

Historically, Chinese prices could be translated into delivered costs with reasonable confidence. A domestic Chinese price, adjusted for value-added tax, logistics, and timing, provided a workable proxy for what a buyer outside China might ultimately pay. The remaining variables were largely operational rather than structural.

That is no longer the case.

Today, the price at which rare earth material is quoted at a Chinese port does not determine the price at which it is ultimately consumed outside China. Between those two points sit a series of cost layers and risk premia that are no longer uniform or predictable.

The FOB China price published by SMM represents the price at which material may leave China, where export is licensed and permitted. It does not reflect the cost of delivery to the point of use, nor does it reflect the conditions under which that delivery occurs. For buyers outside China, the FOB price is therefore a starting point rather than a usable benchmark.

From FOB, landed cost is shaped by freight, insurance, port handling, customs clearance, tariffs, and local taxes. In addition, buyers increasingly face costs associated with inventory buffering, contract optionality, and contingency planning. These are not marginal adjustments. They are structural responses to uncertainty in continuity.

More importantly, the FOB price itself embeds a risk premium. Licensing discretion, volume uncertainty, contract tenor, and end-use scrutiny all influence whether the quoted price can be relied upon. The buyer is not purchasing material alone; they are purchasing access under conditions that may change.

As a result, two buyers referencing the same FOB China price can face materially different landed economics depending on jurisdiction, end use, and risk tolerance. The concept of a single “delivered Chinese price” has effectively disappeared.

The contrast with non-Chinese supply is instructive. For ROW producers, pricing increasingly reflects cost of production plus a defined return on capital. While absolute price levels may be higher, the structure is simpler. The quoted price more closely approximates the delivered economic cost, because continuity is embedded contractually rather than inferred.

In this context, apparent price differentials between Chinese and non-Chinese supply can be misleading. A lower FOB China price does not necessarily translate into a lower delivered cost once risk, logistics, and compliance are accounted for. Conversely, a higher ROW price may represent a lower total economic cost once continuity and duration are factored in.

This breakdown in price comparability has important implications. Buyers cannot optimise procurement purely on headline price. Investors cannot rely on spot prices to assess project economics. Policymakers cannot infer supply adequacy from published benchmarks alone.

Landed cost, rather than quoted price, becomes the relevant economic variable. And landed cost is increasingly shaped by structure, risk, and duration rather than by marginal supply-demand balance.

This is the point at which traditional market-clearing logic breaks down. Prices still exist, but they no longer perform their coordinating function across the system. They do not signal when investment should occur, nor do they ensure that supply responds when scarcity emerges.

5. PRICE FLOORS, RISK SHARING, AND THE RESTORATION OF INVESTABLE SUPPLY

The emergence of price floors in rare earth markets reflects a failure of conventional price signals rather than an attempt to elevate prices. In a market where spot prices no longer convey information that capital can rely upon, the central problem is not insufficient price, but insufficient duration.

For non-Chinese supply, prices have repeatedly risen in response to scarcity, only to fall before investment could be deployed and recovered. This has occurred both when prices were driven by policy constraint and when they were driven by genuine demand growth. In each case, the window in which prices remained elevated proved too narrow for financing to close. Capital learned that price alone was not enough.

Price floors address this specific failure. Their function is to stabilise downside outcomes over an investment horizon, allowing capital to be committed with confidence that revenues will persist long enough to support debt service and capital recovery. They do not prevent prices from rising when market conditions tighten, nor do they attempt to predict equilibrium. They simply define the minimum conditions under which supply can be sustained.

In this sense, price floors are risk-management instruments rather than market distortions. They replace volatile and inaccessible price references with a qualified benchmark that reflects the economic cost of secure supply. That benchmark is anchored in production cost and an explicit return on invested capital, rather than in short-term supply–demand equilibria that new entrants cannot access or rely upon.

This logic is not new. Following the 2010–11 price shock, Japan supported Lynas through a combination of offtake commitments and financing support, effectively sharing early-stage risk until alternative supply could be established. That intervention was limited in scope and duration, but it proved sufficient to stabilise supply and restore continuity. Once downstream capacity and market confidence improved, support was reduced without entrenching permanent distortion. The significance of the Japanese intervention lies not in its scale, but in its demonstration that temporary risk sharing, combined with credible pricing, can restore supply where price signals alone have failed.

What is different today is not the principle, but the scale and formality with which it is being applied. As the requirement for diversification has shifted from individual projects to system-wide supply chains, similar mechanisms are now being deployed more explicitly and across a broader industrial base.

In the United States, defence-linked procurement mechanisms — operating under successive administrations and evolving institutional structures — together with development finance and export credit institutions, are being used to anchor long-term demand and pricing for strategically critical materials. Long-term offtake agreements, cost-plus pricing arrangements, asset-backed loans, and credit guarantees are being deployed to recalibrate risk to a level acceptable to private capital.

These instruments do not replace market pricing; they stabilise it during the period in which alternative supply chains are being established. Price floors provide revenue durability, while public financing structures reduce capital risk. Together, they convert strategic intent into investable projects without requiring permanent subsidy or insulation from competition.

In the early stages of rebuilding rare earth supply outside China, some degree of risk sharing is unavoidable. This is not because the underlying economics are unsound, but because the market itself is incomplete. Until diversified supply chains, downstream capacity, and alternative price references are established, early projects operate in an environment where price credibility has yet to be restored and demand coordination remains imperfect.

Temporary risk sharing addresses this gap. By absorbing a portion of early-stage market and pricing risk, governments can accelerate the formation of a functioning market rather than permanently substituting for it. The objective is not to shield projects from competition, but to allow them to reach scale and integration.

Within this framework, loans and guarantees secured against physical assets are increasingly being used to recalibrate risk to a level acceptable to private capital. By anchoring support to tangible infrastructure rather than to price outcomes alone, these instruments preserve market discipline while reducing downside exposure during the transition phase.

Asset-backed loans, credit guarantees, and similar structures do not eliminate risk; they redistribute it. Construction, operational, and market risks remain with project sponsors and investors, while specific risks associated with early market formation are partially absorbed by public balance sheets. This enables private capital to participate without requiring open-ended price protection.

As alternative supply becomes established, these mechanisms can be withdrawn. Assets are refinanced, guarantees expire, and pricing increasingly clears without intervention. The objective is not to institutionalise support, but to restore the conditions under which price signals once again coordinate investment and supply.

6. OEM CONSTRAINTS AND THE LIMITS OF PRICE ACCEPTANCE

While price floors and cost-anchored pricing are necessary to restore investable supply, they operate within clear constraints on the demand side. Original equipment manufacturers cannot absorb indefinitely higher input prices, even where those prices reflect the true cost of secure supply.

OEM resistance to higher rare earth prices is not a rejection of supply security. It is a function of competitive reality.

Manufacturers of electric vehicles and other electrified products operate in markets that are already under intense margin pressure. They face competition on multiple fronts: from Chinese electric vehicle producers with deeply integrated domestic supply chains, and from internal combustion engine vehicles produced outside China, which continue to benefit from mature, amortised supply chains and lower component costs.

In the United States, tariffs on Chinese electric vehicles — including measures as high as 100 percent — may limit direct market penetration. However, tariffs do not eliminate competition; they shift it. Chinese producers remain aggressive in third markets, exerting downward pressure on global pricing and margins. At the same time, ICE vehicles produced in the rest of the world remain tariff-free competitors in many jurisdictions and continue to set a cost benchmark for consumers.

A similar dynamic is visible in Europe. Despite strong policy rhetoric from France and the European Union on strategic autonomy and critical raw materials, European OEMs have been reluctant to make long-term commitments that would anchor new supply. This reluctance has practical consequences. Even established industrial players such as Solvay, with existing separation capability and deep technical credibility, have struggled to secure long-term feedstock agreements on terms that would support durable investment.

The reason is not a lack of capability or intent. It is unresolved commercial risk. European OEMs remain exposed to intense competition both from Chinese electric vehicle producers in global markets and from lower-cost internal combustion engine vehicles produced elsewhere. In that context, long-term commitments at prices perceived as structurally higher than historic benchmarks are viewed as a competitive liability, regardless of policy alignment or strategic signalling.

This disconnect illustrates the limits of policy statements in the absence of credible pricing and risk frameworks. Fine words do not substitute for contracts. Until pricing durability, downside protection, and risk-sharing mechanisms are addressed explicitly, European OEMs will continue to defer long-term commitments, and downstream actors such as Solvay will remain unable to translate strategic alignment into bankable supply chains.

This pushback does not invalidate the case for price floors. It defines their boundary conditions.

For price floors to be durable, they must stabilise supply without pushing OEM input costs beyond levels that can be absorbed competitively. This is why effective price floors are anchored to production cost and capital recovery rather than scarcity premiums. They aim to make supply viable, not to maximise producer margins.

It is also why downstream qualification matters. Price support that is linked to integrated value chains — rather than to upstream extraction alone — reduces cost leakage, improves efficiency, and limits the pass-through burden to OEMs. Secure supply delivered through shorter, more transparent chains is economically preferable to insecure supply delivered through volatile spot markets or conditional exports.

In this sense, OEM resistance to high prices and producer demand for price stability are not opposing forces. They are two sides of the same coordination problem. Both require prices that are credible, durable, and economically defensible.

The implication for policy design is clear. Price floors and risk-sharing mechanisms must be calibrated not only to attract capital, but also to preserve downstream competitiveness. When that balance is achieved, OEMs can support supply diversification without undermining their own market position.

7. COORDINATING SUPPLY SECURITY AND OEM COMPETITIVENESS

The tension between supply security and cost competitiveness is often framed as a conflict between producers and OEMs. In practice, it is a coordination problem. Both sides depend on prices that are credible, durable, and economically defensible, yet neither can resolve the problem independently.

OEMs cannot commit to higher input costs unless those costs are predictable and proportionate to long-term value. Producers cannot invest without confidence that demand will persist at prices that support capital recovery. Spot markets, fragmented procurement, and short-term contracts are ill-suited to resolving this mismatch.

The resolution lies not in price escalation, but in coordination of demand and supply over time.

One mechanism is structured offtake. When OEMs participate in long-term offtake agreements—either individually or through aggregated demand platforms—they reduce volume risk for producers while gaining visibility over input costs. This does not require OEMs to underwrite projects unconditionally; it requires only that they commit to purchasing at prices that reflect the true cost of secure supply.

Aggregation is particularly important. Individually, few OEMs are willing to anchor a full rare earth project. Collectively, demand is sufficient to do so. By pooling commitments across sectors or jurisdictions, OEMs can support diversification without bearing disproportionate exposure.

Downstream qualification is the second coordinating mechanism. When OEMs specify sourcing requirements that privilege integrated value chains—covering separation, metallisation, and magnet production—they reinforce the economic logic of price floors without directly subsidising extraction. Secure supply delivered through shorter, more transparent chains is more compatible with cost control than reliance on volatile spot markets or conditional exports.

A third mechanism lies in contract design. Price floors can be embedded in supply agreements as minimum-price provisions rather than fixed prices. This allows OEMs to retain upside participation when market conditions soften, while ensuring that producers are protected against downside shocks that would otherwise halt investment. Risk is shared but not socialised.

Importantly, these arrangements do not insulate OEMs from competition. OEMs must continue to compete against Chinese electric vehicle producers in global markets and against internally combustion engine vehicles produced elsewhere. Tariffs may limit direct import competition in some jurisdictions, but they do not eliminate margin pressure or consumer price sensitivity. Any pricing framework that ignores this reality will fail.

The implication is that successful coordination requires cost realism rather than strategic aspiration alone. Prices that reflect production cost plus a reasonable return on capital are defensible. Prices driven by scarcity premiums are not. OEM participation depends on this distinction.

Over time, as diversified supply chains mature and alternative pricing references become credible, the need for explicit coordination diminishes. Price floors can be relaxed, risk-sharing withdrawn, and procurement normalised. The objective is not to lock in special arrangements, but to transition toward a market in which security of supply and competitiveness are no longer in tension.

In this sense, OEMs are not the obstacle to supply diversification. They are the final piece of the solution. When pricing, financing, and contract structures are aligned with their competitive constraints, OEMs can support the emergence of resilient supply chains without compromising their ability to compete.

8. CONCLUSION — RESTORING PRICE CREDIBILITY IN A COMPETITIVE TRANSITION ECONOMY

The central problem addressed in this paper is not the level of rare earth prices, but their failure to perform their coordinating function. Prices have repeatedly moved in response to scarcity, policy intervention, and demand growth, yet they have not persisted long enough, nor carried sufficient credibility, to mobilise durable non-Chinese supply.

This failure is now structural. Chinese pricing no longer clears a single global market. Domestic prices reflect internal demand and value capture, while export prices embed conditional access and discretion. Neither provides a stable or accessible reference for investment outside China. At the same time, spot prices elsewhere remain too volatile and too short-lived to support financing. The result is a market in which scarcity is visible, but investment does not respond.

The consequence has been repeated capital scarring. Episodes in which prices appeared supportive of new supply were followed by rapid reversals, reinforcing the perception that rare earth markets cannot be underwritten on price signals alone. This experience explains the persistent reluctance of private capital, even as strategic awareness has increased and demand has continued to grow.

Against this backdrop, the emergence of price floors should be understood not as a distortion of markets, but as a corrective to a specific failure. Properly designed price floors do not seek to elevate prices or suppress competition. They seek to restore duration to price signals, anchoring revenues to the economic cost of secure supply and an explicit return on capital. In doing so, they convert abstract scarcity into financeable cash flows.

Crucially, price floors do not operate in isolation. Their effectiveness depends on being embedded within a broader framework that includes conditionality, transitional risk sharing, and credible exit mechanisms. Expressed at the oxide level, price support must be linked to downstream capability to avoid reinforcing stranded or extractive-only capacity. Asset-backed loans and guarantees recalibrate early-stage risk without displacing market discipline. As supply chains mature, these mechanisms can and should be withdrawn.

Equally important are the constraints faced by OEMs. Resistance to higher input prices is not a failure of strategic intent, but a reflection of competitive reality. OEMs must compete not only against vertically integrated Chinese producers, but also against established internal combustion engine supply chains that continue to set cost benchmarks in many markets. Tariffs may alter the geography of competition, but they do not eliminate margin pressure or price sensitivity.

The European experience illustrates this clearly. Despite strong policy rhetoric from France and the European Union on strategic autonomy and critical materials, long-term commercial commitments have been slow to materialise. Even credible downstream players such as Solvay, with established separation capability, have struggled to secure long-term feedstock agreements on terms that support durable investment. The gap between policy ambition and contractual reality underscores the limits of signalling in the absence of credible pricing and risk frameworks.

The resolution lies in coordination rather than confrontation. Through structured offtake, demand aggregation, and contract designs that embed price floors without fixing prices, OEMs can support supply diversification while preserving competitiveness. Producers gain the revenue durability required to invest; OEMs gain predictability and security of supply without assuming open-ended cost exposure.

Taken together, these elements form a coherent framework for restoring price credibility in rare earth markets. Prices regain their ability to coordinate investment, not because they are higher, but because they are credible, durable, and economically defensible. Capital responds, supply diversifies, and dependency is reduced without relying on permanent intervention.

This framework is not an end state. It is a transition mechanism. Its success should be measured not by the longevity of price floors or public support, but by their ability to make themselves redundant. When diversified supply chains are established, downstream capacity is scaled, and alternative price references are trusted, markets can once again clear without intervention.

Until then, the task is not to wait for prices to solve the problem, but to restore the conditions under which a competitive transition economy can function as a solid reality.

Rare Earths Aren’t Rare… and Why That Framing Devalues the Material

Abundance is not supply.

“Rare earths aren’t rare” is a line we’ve all read countless times. It’s also where the story usually goes wrong. This short article explains why geology is the easy part — and why processing, scale, and control matter far more.

“Rare earths aren’t actually rare. They’re a group of 17 elements that occur together in the Earth’s crust and are relatively abundant across the planet.”

That is how most mainstream articles on rare earths begin — a sentence so familiar that anyone who works in or invests in the sector can write it before the journalist has had their first coffee — and it is where the importance of the material is immediately diluted.

While many rare earth elements are geologically abundant, they are rarely found in economic concentrations, rarely separable without complex and capital-intensive processing, and rarely produced at scale in ways that are environmentally and politically acceptable. Mining is not the constraint; separation and refining are.

By focusing on crustal abundance, this framing subtly suggests that supply risk is overstated and that strategic concern is misplaced. In doing so, it devalues the industrial and strategic importance of rare earths, particularly the magnet metals that underpin electric vehicles, wind turbines, robotics, advanced electronics, and defence systems.

Rare earths are chemically similar and typically occur together, historically requiring hundreds of sequential solvent-extraction stages to isolate individual elements. This is why control of processing capacity — not geology — has defined global supply.

That picture, however, is beginning to evolve. New separation approaches, including those being developed by ReElement Technologies, aim to reduce process complexity, lower environmental impact, and improve economic efficiency. These advances represent genuine technological progress and are an important part of the future rare earths landscape. However, they are still in the process of scaling, and conventional solvent extraction remains the dominant industrial standard today.

For now, control of proven, scalable processing capacity continues to define supply resilience — particularly when paired with high-quality resources and supportive infrastructure. Projects such as Pensana’s Longonjo development illustrate how resource quality, logistics, energy access, and processing strategy together determine whether rare earths move from geological presence to industrial reality.

The argument that rare earths “aren’t rare” is analogous to pointing out that the oceans contain millions of tonnes of gold. Technically true — economically meaningless. Without concentration, recoverability, and processing capability, abundance has little value.

So when those who work in or invest seriously in the sector push back on the phrase “rare earths aren’t rare,” it is not pedantry. It is frustration with a framing that trivialises complexity, understates risk, and obscures where real value — and vulnerability — reside.

Rare earths are geologically common and industrially scarce.

That distinction is not academic. It sits at the heart of the strategic minerals debate.

WHEN SUPPLY NO LONGER MEETS DEMAND

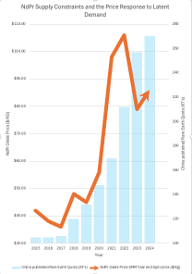

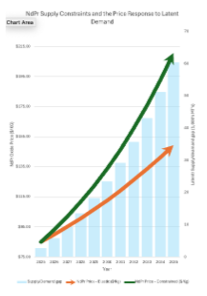

For much of the past decade, rare earth prices have remained largely disconnected from underlying demand growth. This outcome was not the result of weak end-use fundamentals, but of sustained supply expansion that absorbed incremental demand and suppressed price signals. Drawing on historical quota and pricing data, this paper shows how supply growth dominated price formation between 2015 and 2024, including the sharp price correction in 2023 driven by an additional quota issuance and a temporary slowdown in demand growth.

The paper then examines the implications of a market in which supply growth becomes more constrained, whether by policy, economics, or project lead times. It argues that as supply elasticity diminishes, prices are increasingly set at the margin rather than by average demand growth. In such conditions, even moderate demand growth can produce materially higher clearing prices, not because of absolute scarcity, but because prices must rise to induce new capacity. These dynamics have important implications for investment, policy, and the development of supply chains outside China.

For much of the past decade, the global rare earths market has operated under a set of assumptions that increasingly no longer hold. Chief among them was the belief that China, as the dominant producer and processor of rare earth materials, would continue to act as a global swing supplier—expanding production as required to stabilise prices and absorb incremental demand from the rest of the world. That assumption underpinned low prices, discouraged investment outside China, and shaped policy responses across the West.

Yet the mechanics that sustained this model were never cost-free. Price stability was achieved not through market balance, but through sustained supply expansion, enforced quotas, and the absorption of global demand into China’s own production system. As long as external demand remained modest relative to China’s domestic requirements, this approach suppressed prices without materially distorting internal cost structures.

That balance appears to be changing. Demand for magnet rare earths continues to grow at mid-single-digit rates, driven by electrification, renewable energy, and advanced manufacturing. At the same time, China’s own downstream industries have expanded rapidly, increasing domestic consumption of strategic materials. The combination has placed growing pressure on the very mechanism that previously stabilised global prices.

This paper explores whether recent shifts in Chinese policy—reduced transparency around production quotas, tighter export controls, and an increased emphasis on domestic demand—may reflect an economic recalibration rather than a geopolitical strategy. It considers one plausible interpretation: that China is becoming less willing or able to subsidise global price stability when external demand risks inflating internal costs.

If that interpretation is even partially correct, the implications are significant. Once China ceases to balance global supply and demand, the rest of the world must rediscover a market-clearing price—one that reflects constrained supply, long lead times, and rising capital requirements. In that environment, higher prices are not a policy choice, but an economic necessity, and investment outside China becomes not just viable, but essential.

When Concentration Becomes the Market

Markets do not possess intent, bias, or memory. They are simply the aggregation of inputs — supply availability, cost, timing, and demand — and the prices that emerge from their interaction. In that sense, THE MARKET IS THE MARKET. It does not misbehave, distort, or signal incorrectly. It clears exactly as it must, given the structure it operates within.

In the case of rare earths, that structure has, for more than a decade, been one of extreme concentration. When a single jurisdiction controls approximately 60% of primary supply and close to 90% of processing capacity, price formation no longer reflects the interaction of a dispersed global supply base. It reflects the internal economics of the dominant system.

At that level of concentration, there is no meaningful external marginal supply. There is no swing producer outside the system capable of responding to price signals, no spare processing capacity through which demand can be independently cleared, and no alternative pathway through which scarcity can express itself. The rest of the world cannot influence price formation because it cannot alter the inputs. It can only observe the outputs.

Under these conditions, prices do not fail to reflect demand. They reflect the dominant system’s ability and willingness to supply incremental volumes. If marginal supply can be expanded within that system at acceptable internal cost, additional demand — whether domestic or external — is absorbed through volume rather than price. Stability is not imposed; it emerges naturally from the structure.

This is why price behaviour over the past decade should not be interpreted as distortion, suppression, or mispricing. Prices behaved exactly as they should have, given the inputs. China did not need to influence the market. By virtue of its position in the supply chain, it WAS the market.

Only when those inputs change — through rising internal demand, increasing marginal costs, environmental constraints, or a recalibration of policy priorities — do price outcomes change. The market itself does not change. It remains what it has always been: the logical output of the structure within which it operates.

Evidence of Supply Expansion: A Decade of Rising Chinese Quotas

This mechanism is visible in the trajectory of Chinese rare earth production quotas over the past decade. Mining and separation quotas rose steadily, often at rates sufficient to absorb both domestic consumption growth and incremental demand from the rest of the world.

The effect of these increases was cumulative. Rather than responding episodically to price spikes, quota expansion acted as a persistent buffer against scarcity. Each increase reinforced the expectation that supply would continue to arrive as needed, anchoring price expectations and limiting the incentive for alternative supply development elsewhere.

The important point is not the precise annual figures, but the direction and persistence of growth. Quotas functioned as a stabilising tool, allowing China to absorb demand shocks internally and export price stability externally.

Flat Prices in a Growing Market

The effectiveness of this strategy is evident in price behaviour. Over the same period that quotas expanded, prices for magnet rare earths such as NdPr remained largely range-bound, punctuated by brief spikes but lacking sustained upward momentum.

This price behaviour is difficult to reconcile with demand fundamentals alone. End-use demand expanded steadily, yet prices failed to respond in a manner consistent with tightening supply. The most plausible explanation was that supply expansion dominated price formation.

The reality was that rising demand was repeatedly met with rising supply, preventing the emergence of sustained scarcity. As a result, price signals that might otherwise have triggered investment outside China were suppressed.

Notes to Chart: Chinese rare earth production quotas expanded steadily between 2015 and 2024, absorbing both domestic and external demand. In 2023, the issuance of three quota rounds rather than the usual two coincided with a sharp deceleration in demand growth following the COVID period, resulting in a pronounced price correction. Despite this temporary dislocation, the broader pattern illustrates how sustained supply expansion dominated price formation over the period.

Why the Old Model Became Unsustainable

The stabilising mechanism described above depended on one critical condition: that marginal supply could continue to be expanded without imposing unacceptable costs elsewhere in the system. Over time, that condition weakened

China’s own domestic demand for rare earths increased sharply as downstream industries—electric vehicles, wind turbines, robotics, electronics, and defence manufacturing—expanded. At the same time, environmental enforcement tightened, illegal mining was curtailed, and marginal ore quality declined. Each additional tonne became more expensive to produce.